Forex

Trade currencies across countries using a variety of strategies and analytical tools.

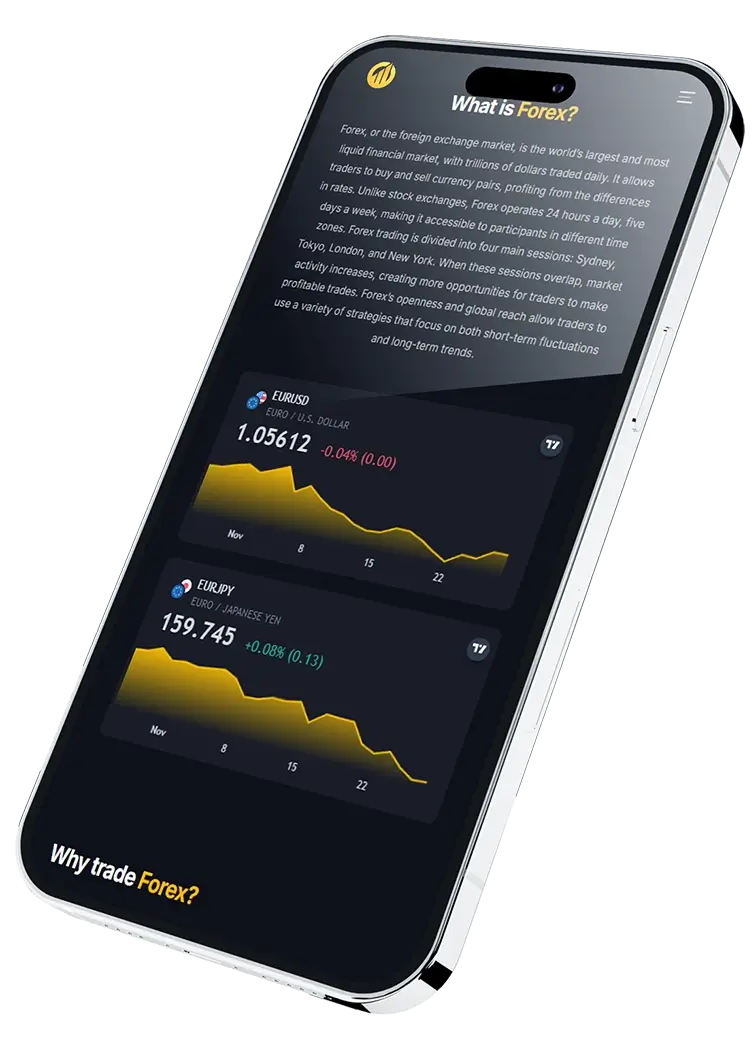

What is Forex?

Forex, or the foreign exchange market, is the largest and most liquid financial market in the world, with daily trading volumes reaching trillions of dollars. This market allows traders to buy and sell currency pairs, making profits on the difference in exchange rates. Unlike stock exchanges, Forex is open 24 hours a day, five days a week, making it available to participants from different time zones. Forex trading is divided into four main sessions: Sydney, Tokyo, London and New York. When these sessions overlap, market activity increases, creating more opportunities for traders to make profitable trades. The openness and global reach of Forex allows traders to use different strategies, both short-term fluctuations and long-term trends.

Why should you trade Forex ?

Forex attracts traders with its flexibility and decentralized structure. Unlike stock markets, there is no central exchange and transactions occur directly between market participants such as banks, brokers, hedge funds and institutional investors. This approach allows trading currency pairs 24 hours a day, regardless of geographic location. Additionally, Forex offers leverage, which enables traders to manage significantly larger amounts of capital than their account balance. The high liquidity of the currency market guarantees quick execution of trades, which is of crucial importance for traders seeking maximum efficiency of their strategies. The variety of available currency pairs makes Forex an attractive platform for diversifying trading portfolios.