Indices

Work with a financial tool that helps limit your losses and facilitate the analysis of the entire industry.

Why trade indices?

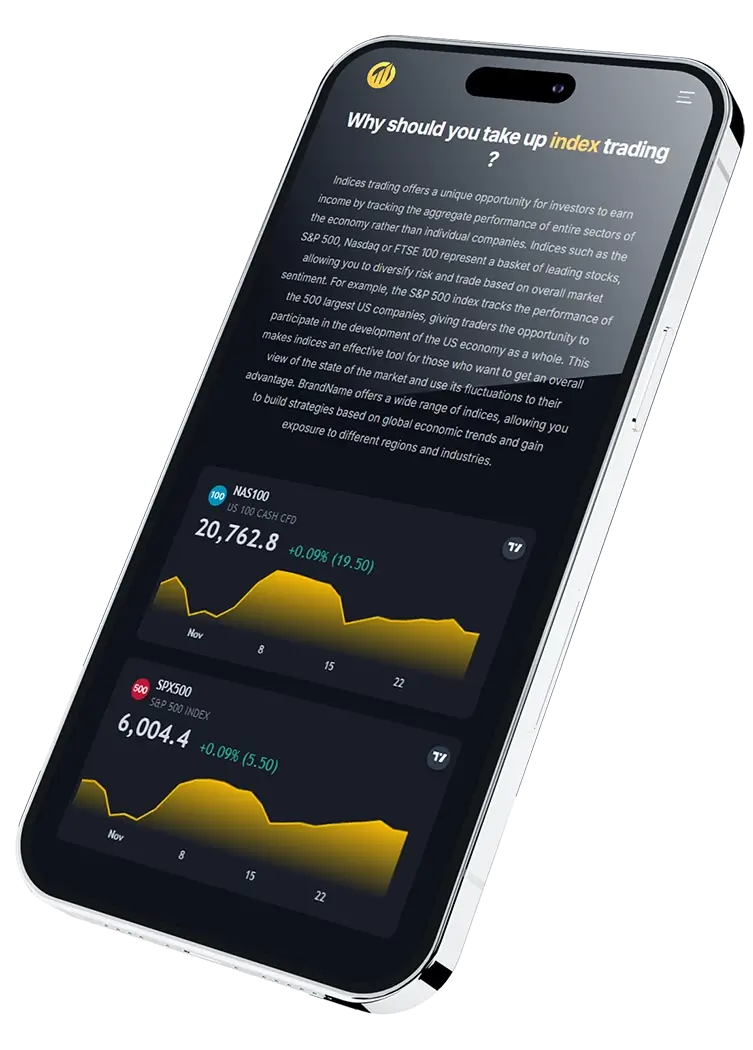

Index trading provides a unique opportunity for investors to earn income by tracking the aggregate dynamics of entire sectors of the economy instead of individual companies. Indices such as the S&P 500, Nasdaq or FTSE 100 are a basket of stocks from leading companies, allowing you to diversify your risks and trade based on overall market sentiment. For instance, the S&P 500 reflects the performance of the 500 largest US companies, giving traders a chance to participate in the development of the American economy as a whole. This makes indices an effective tool for those who want to get a general overview of the market condition and use its fluctuations in their own interest. Caruso Capital offers a wide selection of indices, allowing you to build strategies based on global economic trends and gain access to different regions and industries.

How to trade indices effectively ?

Effective trading in stock markets begins with a clear understanding of market instruments and the use of thoughtful strategies. Trading indices through contracts for difference (CFDs) allows you to profit from both rising and falling markets. Due to CFDs, you can speculate on the price changes of indices such as S&P 500 or Nikkei 225 without having to purchase physical assets. One of the key factors for successful trading is the ability to analyze market trends, using technical analysis tools, as well as considering economic and political events that may affect the market. Caruso Capital offers you not only access to a broad range of indices, but also advanced analysis tools, enabling you to adapt your strategies to changing conditions and find new opportunities for maximizing profits.